Does the Standard Deduction tell a story?

how the tax system suggests certain behavior.

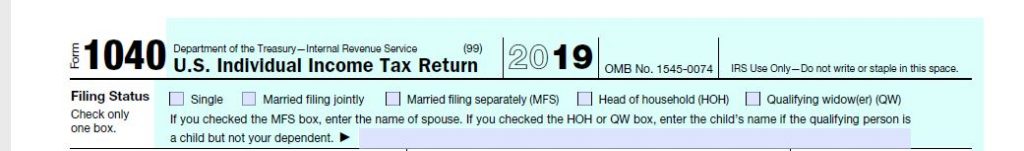

The first calculation is Filing Status. There are 5 filing statuses. Your filing status affects the total amount you pay in taxes because it determines eligibility for deductions, the amount of the standard deduction and your tax rate. The five filing statuses are:

1. Single- allows all tax credits with the least standard deduction and highest tax bracket.

2. Married filing jointly– allows all tax credits with maximum standard deduction and the lowest tax bracket.

3. Married filing separately- does not allow all tax credits with least standard deduction and the highest tax bracket.

4. Head of household– allows all tax credits with favorable standard deduction and a favorable tax bracket.

5. Qualifying widow(er) with dependent child– allows all tax credits with favorable standard deduction and a favorable tax bracket.

The tax code applies according to your filing status. Married filing Jointly is the most favorable under most circumstances. Consider this to be part of the Financial Literacy we promote at Power Taxx Ltd, www.powertax.com

One of the benefits of married filing Jointly is the higher Standard Deduction. A higher Standard Deduction allows more of your hard earned to be TAX FREE. Another benefit is that you may qualify for a lower tax bracket. The result is you pay less taxes consequently there will be less money withheld from your earnings. All of those benefits allow you to pay less tax and keep more money in your pocket.

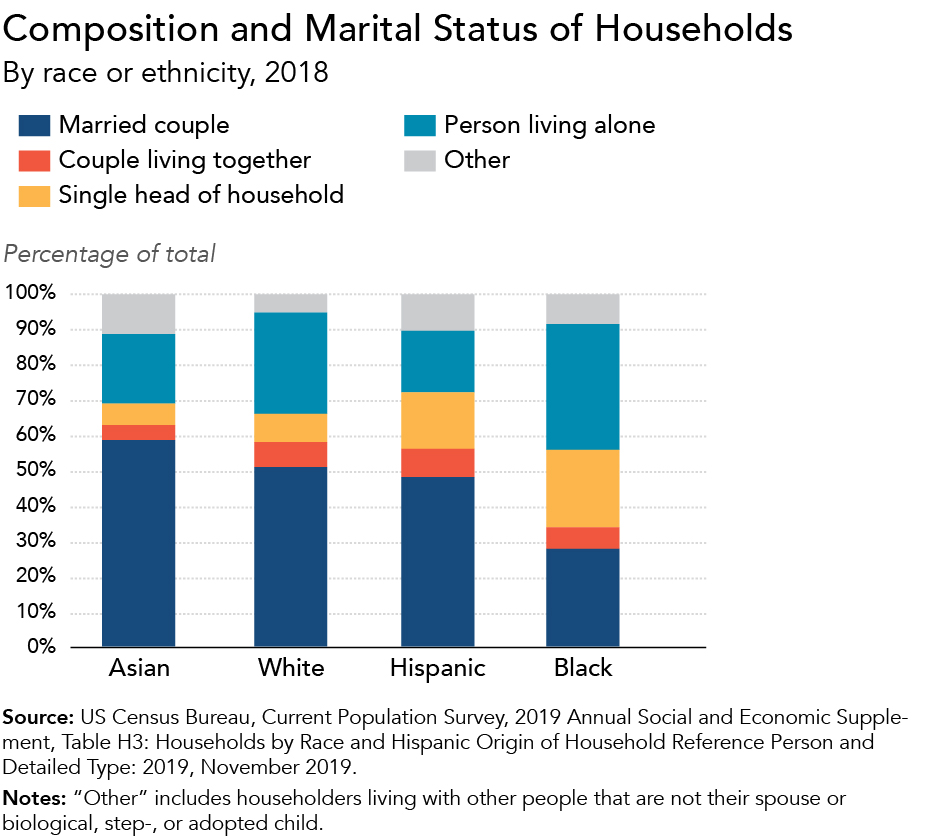

I want to point out how according to statistics of the US Census Bureau too many Black families in America are missing out on the benefits of the Married filing Jointly status largely because of the single parent phenomenon.

The historic destruction of the Black Family structure has present day Tax implications. The result is that more Black individuals and families are paying more taxes because of their filing status. Though they pay more taxes they still have less political representation.

Paying more taxes results in less take home pay which results in less discretionary income if any at all. Discretionary income is the amount of an individual’s income that is left Over for Saving, Investing and Starting a Business after paying for all the necessities of life.

The normalization of the single parent black family is detrimental for everyone. The SOLUTION is twofold as the PROBLEM is twofold. 1. Black Families could unite under the banner of matrimony for the benefit of Self Preservation and Self Elevation. 2. The societal solution includes that the media attacks through stereotyping, the hollywood stereotypes, the music industry stereotypes the political attacks through criminalization and the legislative attacks which are all historically and presently DOCUMENTED need to CEASE AND DESIST IMMEDIATELY.

Proactive reparational steps need to be executed immediately or we must all suffer the consequences. Black family Destruction is Destruction of the entire nation. No nation can benefit from destroying its own people. Black Family progress is progress for the entire nation. These discrepancies should not be normalized they are Extremely Alarming.

We should not be to busy or to safely situated to address the betterment of millions of people in america. Black families are denied access to the fruits of the labor of the their ancestors. imagine if YOU were denied the fruits of the labor of your ancestors. You would be livid and rightly so.

by Steven Hutchinson Tax Pro

To Be Continued….